Investing Along the Green Line: Calgary’s Next Big Real Estate Opportunity

Calgary is a city on the move—literally and figuratively. As it expands outward and densifies inward, urban infrastructure projects are reshaping the way people live, work, and travel. Among the most transformative of these initiatives is the Green Line LRT, an ambitious rapid transit line that will span the city from north to south, connecting key residential, employment, and cultural nodes. This isn't just another transportation project; it's a blueprint for the city's future and a signal to investors about where the next pockets of opportunity will emerge. The Following is Calgary Real Estate Wealth’s deep dive into how the Green Line will affect real estate investment in Calgary.

Transit infrastructure has long been one of the most powerful catalysts for real estate development. In cities like Toronto, Vancouver, and Montreal, the presence of a nearby subway or train line has driven up property values, boosted rental demand, and triggered waves of gentrification and renewal. Calgary, traditionally more car-centric, is now moving in a similar direction with the Green Line. The first phase, currently under construction, spans from Shepard in the southeast to 16 Avenue North, running through established and emerging neighbourhoods like Inglewood, Ramsay, Ogden, and downtown.

What makes the Green Line unique is its strategic alignment with Calgary’s broader goals: increasing urban density, improving livability, and reducing the environmental footprint of daily commutes. The city has committed to Transit Oriented Development (TOD), which means rezoning and planning will actively encourage higher-density housing, mixed-use spaces, and walkable communities near Green Line stations. For investors, this is a clarion call: real estate near these transit nodes is about to become a lot more valuable.

The economic rationale is simple. Access to rapid transit improves quality of life by reducing commute times and increasing mobility—features that tenants and buyers are increasingly prioritizing. Whether it’s a young professional looking for a condo near downtown, a family seeking affordable housing with reliable transit to school and work, or a retiree wanting convenience without the need for a car, the Green Line will cater to a broad spectrum of urban dwellers.

Moreover, the Green Line isn't being built in isolation. It coincides with Calgary's evolving identity as a post-oil-boom city that is diversifying its economy. With population growth continuing and job markets stabilizing, there is renewed interest in urban living. Downtown revitalization efforts, new entertainment districts, and major civic projects like the BMO Centre expansion and the Event Centre are all helping to increase demand for centrally located housing.

This creates an alignment of macro and micro trends: government-backed infrastructure, municipal policies that favour urbanization, changing demographic preferences, and investor appetite for reliable, long-term gains. It’s a scenario where early movers—those who identify the right neighbourhoods, secure the right properties, and hold for the right amount of time—stand to benefit immensely.

It’s also important to note that the Green Line is not a short-term play. While some value appreciation may occur in anticipation of the line’s completion, the biggest gains are likely to be realized over a longer horizon, particularly as communities evolve and new businesses, services, and residents move in. For investors willing to play the long game, this is a rare opportunity to align with a city-building initiative of generational scale.

The Green Line will redefine how Calgarians live and move. For real estate investors, it offers a clear and compelling roadmap: follow the tracks.

What Is the Green Line?

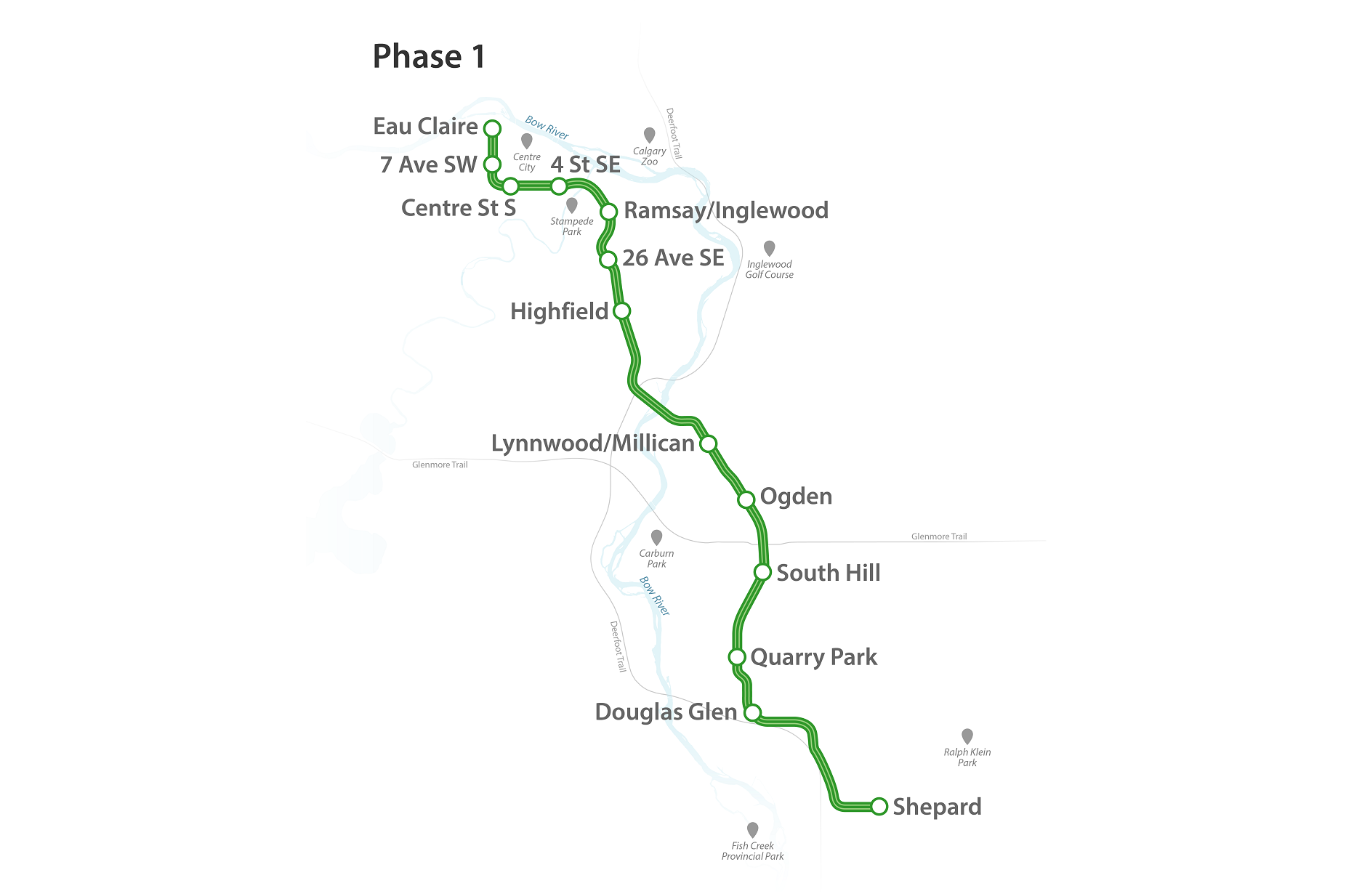

The Green Line is a new light rail line that will eventually run from Shepard in the southeast to 16 Avenue N in Phase 1, with future phases extending toward the north central quadrant. Phase 1 alone is an over $5.5 billion investment, with construction officially underway and service expected to begin in 2030–2031.

More than just another LRT extension, the Green Line is strategically planned to connect key residential, employment, and redevelopment hubs—like Inglewood, Ramsay, Ogden, and downtown. That means the areas along the route are primed for revitalization, densification, and investor interest.

Why It Matters for Investors

The decision to invest in real estate is ultimately about identifying value—and more importantly, identifying value before it becomes widely recognized. That’s precisely what makes the Green Line such a compelling proposition for Calgary investors. It’s not just about where the city is today, but where it’s going tomorrow. The Green Line represents a once-in-a-generation urban infrastructure project that will reshape the landscape of Calgary real estate for decades to come.

Transit-oriented development (TOD) is a proven concept globally. From London and Tokyo to Vancouver and Toronto, the pattern is clear: properties located within walking distance of reliable, high-frequency public transit consistently outperform those without such access. These properties command higher resale values, maintain stronger rental demand, and show resilience during economic downturns. Calgary has historically lagged in TOD adoption, but the Green Line is about to change that.

Investors should view the Green Line as a blueprint for where Calgary’s next growth corridors will be. The city has explicitly committed to increasing density near transit stations, changing land-use bylaws, and supporting mixed-use development. That means the regulatory framework will increasingly favour projects like fourplexes, mid-rise condos, and commercial-residential hybrids near Green Line stops. These changes lower the barriers for developers and provide new opportunities for small and mid-sized investors alike.

Moreover, transit boosts both affordability and accessibility—two of the most important drivers of real estate demand. As Calgary continues to grow, not everyone will want or be able to live in detached homes with two-car garages. Young professionals, downsizers, newcomers, and students are all seeking alternatives that combine affordability with convenience. Properties within 400–800 meters of a Green Line station are likely to attract these demographics, translating to lower vacancy rates and more consistent cash flow.

There is also the matter of psychological value. Properties near a major transit line often benefit from what economists call "anticipatory appreciation."—buyers and renters expect values to rise, so they act accordingly. Even before the Green Line is operational, investors who get in now may benefit from speculative price increases, especially as public awareness and media attention around the project grow. This has already been seen in early-stage bidding wars and increased sales activity in neighbourhoods like Ogden and Inglewood.

The impact isn’t just on residential properties. Commercial real estate near transit hubs typically benefits from increased foot traffic, improved visibility, and longer lease terms. Mixed-use buildings with retail on the main floor and residential above can generate dual income streams and hedge against market fluctuations. For investors thinking long-term, these mixed-use developments offer flexibility and resilience.

For those focused on rental income, the Green Line presents significant advantages. Calgary has experienced periods of tight rental supply, and the introduction of new transit options can ease transportation burdens while increasing demand for well-located rental units. Savvy investors can purchase undervalued properties near future stations, legalize suites, and command premium rents once the line opens. Even before completion, the promise of a future transit link can be a powerful marketing tool.

Lastly, Calgary's municipal government is investing in infrastructure, placemaking, and community services to complement the Green Line. This includes upgrades to public spaces, parks, cycling paths, and main streets near Green Line corridors. Such improvements not only attract new residents and businesses but also reinforce long-term value creation for nearby real estate.

In sum, the Green Line isn’t just about building a railway. It’s about building the next chapter of Calgary’s urban story. For real estate investors, the line offers a literal and metaphorical track to follow. Whether you're aiming for appreciation, cash flow, or a development opportunity, understanding the interplay between transit, planning policy, and market demand will be the key to long-term success. Those who act early and strategically will be best positioned to ride this wave of transformation.

Neighbourhoods to Watch

With the Green Line LRT under construction, certain Calgary neighbourhoods are entering a new era of opportunity. As an investor, understanding the characteristics and trajectories of these communities is essential. Below are some of the top neighbourhoods along the Phase 1 Green Line, each offering unique angles for investment:

Ramsay/Inglewood

Ramsay and Inglewood are among Calgary’s oldest communities, brimming with heritage charm, brick facades, and character homes. These areas already enjoy popularity due to their walkability, proximity to downtown, and strong community identity. The coming Ramsay/Inglewood Green Line station will add another layer of accessibility, making this location even more desirable.

In recent years, these neighbourhoods have seen steady gentrification, with older homes being replaced by modern infills and townhomes. Investors should watch for upzoning potential and small-scale multi-family redevelopment opportunities. The nearby Inglewood Business Revitalization Zone also adds to long-term value through its growing network of boutique shops, cafes, and art galleries. The area has become a favourite among young professionals and creatives, which also supports robust short- and mid-term rental strategies.

Additionally, the new transit connectivity will likely make this an even more attractive spot for office-to-residential conversions in underutilized commercial spaces. With City of Calgary incentives in place for densification near transit hubs, Ramsay/Inglewood is well-positioned to become a model TOD (transit-oriented development) zone.

Ogden

Ogden is a working-class neighbourhood that has remained under the radar for many years. However, its fortunes are changing rapidly with the upcoming Ogden Green Line station. Investors willing to get in early can find some of the lowest per-square-foot prices within the inner-city ring, offering ample room for appreciation.

The area is particularly appealing for buy-and-hold investors who want to generate cash flow while waiting for property values to rise. Single-family homes with large lots are ideal candidates for legal basement suites or backyard laneway housing, especially with the city's focus on gentle densification.

The community’s industrial history is also slowly giving way to mixed-use potential, with developers eyeing properties for small-scale retail, light commercial, or medium-density residential infills. Moreover, Ogden's proximity to the Bow River and the future Glenmore Trail upgrades will only improve its accessibility and livability. For investors looking for an affordable entry point into Calgary’s growth story, Ogden is a diamond in the rough.

Victoria Park/Beltline

While not directly on the Green Line, Victoria Park and Beltline will benefit immensely from enhanced downtown connectivity and increased urban foot traffic. These dense, urban neighbourhoods are already investment hotspots, but the Green Line cements their long-term appeal.

Victoria Park is undergoing a transformation, with new high-rise condo developments, mixed-use towers, and entertainment venues like the BMO Centre expansion and the Calgary Stampede Grounds revitalization. For short-term rental investors, these areas offer unbeatable proximity to major events, nightlife, and business centers.

The Beltline, often considered Calgary’s most walkable community, attracts a mix of young professionals, renters, and students. It’s a great spot for condo investments, especially for those who want to cater to tenants who prioritize transit access, nightlife, and amenities. Property managers in these neighbourhoods report high tenant turnover but also strong demand, making vacancy risk low. Investors should also keep an eye on older buildings that may qualify for renovation incentives or conversion grants.

Shepard (SE Calgary)

Located at the southern end of the initial Green Line phase, Shepard is a newer, suburban-style area poised for explosive growth. While it’s still developing, future residential and commercial plans are extensive, with multiple master-planned communities underway.

The area offers large, modern homes at competitive prices, making it a strong candidate for families and long-term tenants. Investors can target pre-construction townhomes and detached houses for appreciation plays, or consider purpose-built rentals aimed at the growing workforce in southeast Calgary.

Shepard’s strategic position near industrial employment hubs, as well as planned retail and community amenities, means it will serve as both a residential anchor and a commercial node. The future Green Line station will provide direct access to downtown, which will be a game-changer for commuters. With minimal existing rental inventory, the first wave of investor-owned rentals could see significant early demand.

What to Consider Before Investing

Transit-oriented investments can be lucrative, but they also come with unique considerations. Whether you’re planning to buy and hold, renovate and flip, or develop from the ground up, it’s important to weigh all variables before making a commitment. CREW Property Services can assist you with the right renovations for any renovation or flip. Here are key factors to analyze when investing near the Green Line:

1. Timeline and Project Risk

The Green Line is a large-scale infrastructure project with many moving parts. While construction is underway, large transit projects often face delays due to political shifts, budgetary constraints, or unforeseen engineering challenges.

As an investor, you should be prepared to hold your property for 5 to 10 years to fully realize value appreciation from the Green Line. If your investment horizon is shorter, you may want to focus on areas with existing momentum, such as Beltline or Ramsay, rather than speculative future nodes.

In addition, monitor city council updates and project timelines closely. Join mailing lists, attend public information sessions, and speak with city planners or transportation consultants to stay ahead of any changes.

2. Zoning and Redevelopment Potential

Many of the neighbourhoods near the Green Line are subject to Calgary’s densification policies. This includes rezoning initiatives that allow for the development of rowhouses, multi-family dwellings, and mixed-use properties in areas previously limited to single-family homes.

Before buying, review the property’s current zoning and check whether it falls within a "Transit Oriented Development" area. These zones often have more flexible land-use bylaws and access to city incentives for development.

Infill developers, in particular, should look for wide lots, corner lots, or properties adjacent to main roads, as these are ideal for duplexes, fourplexes, or small apartment buildings. Check for recent sales of comparable properties to understand land value trends and construction feasibility.

3. Target Tenant Profiles

Proximity to transit is especially appealing to certain types of tenants. Young professionals, students, seniors, and those without vehicles often prioritize access to reliable public transportation.

Identify which demographics are most active in the neighbourhood you're targeting. For instance, Ramsay may appeal to creatives and young couples, while Shepard could attract families and blue-collar workers. Tailor your renovation scope and amenities accordingly. For example, high-end finishes and in-suite laundry may command premiums in Beltline, while in Ogden, affordability and parking may be more important.

Also consider furnished vs. unfurnished rentals and short-term vs. long-term leases depending on location and tenant demand. CREW Property Leasing can find and manage the best tenants for any investor.

4. Financing and Cash Flow Forecasts

Banks and mortgage lenders may take a conservative approach when appraising speculative areas, particularly if the Green Line station is not yet complete. Work with a mortgage broker like Danielle DiMarco from Calgary Real Estate Wealth who understands the Calgary market and can help you find a lender comfortable with TOD investments.

Model cash flow conservatively. Account for delays in rent growth, property appreciation, and even the construction timeline of nearby infrastructure. If you’re buying a fixer-upper, get detailed quotes from contractors and budget a 10–20% contingency. Check city tax rates, utility costs, and insurance premiums, which can vary by neighbourhood.

If you're leveraging HELOCs or joint ventures, ensure your partners understand the long game associated with transit-based investment.

5. Community Support and Opposition

Neighbourhoods undergoing rapid change sometimes face pushback from residents who fear gentrification, traffic, or changes to community character. While this is a natural part of urban evolution, it can slow down rezoning applications or development approvals.

Look into local community associations and read meeting minutes if available. If there is significant opposition to redevelopment, be prepared for a longer permitting process or the need to modify your design plans.

Being proactive—such as attending community meetings and engaging with local stakeholders—can help smooth the path to approval and improve your project’s long-term integration into the neighbourhood.

6. Infrastructure and Amenity Access

While the Green Line is the centerpiece of this investment thesis, other infrastructure also plays a role in a property’s value. Proximity to parks, schools, employment hubs, and grocery stores all add to the attractiveness of a rental or resale.

Before investing, assess what supporting infrastructure is in place or planned nearby. Shepard, for example, may lack some amenities today, but master-planned communities often include future school sites, shopping plazas, and recreational centers. Ramsay and Beltline, by contrast, offer nearly complete infrastructure but may come with higher purchase prices.

Use tools like Walk Score and Calgary's planning maps to evaluate neighbourhood amenities. Speak to local Realtors and residents to get a real sense of livability.

Investing near Calgary’s Green Line can be highly rewarding—but only if you understand the broader dynamics at play. By focusing on neighbourhoods with solid fundamentals and factoring in zoning, financing, and community attitudes, investors can position themselves for strong returns as the city’s transit future takes shape.

Calgary Real Estate Wealth is a full service real estate investment firm that sources, analyzes & negotiates premium investment properties for its investors since 2006. Calgary Real Estate Wealth offers mentorship on all aspects of real estate investing investing through bi-weekly webinars, blogs, podcasts, books & its You tube channel, CREW TV. Calgary Real Estate Wealth also offers, through it's leasing division, CREW Property Services, tenant placement services, ongoing leasing services, and property maintenance and renovations for each property purchased. Real estate investing has never been so easy!

If you're interested in deeper dives on Calgary neighborhoods, investment calculators, or walkthroughs of actual deals, be sure to subscribe to the blog. More Alberta-focused real estate content is coming your way.